Utilities in southern states are evolving towards a renewable future by embracing their solar energy potential and developing beyond federal renewable energy requirements. Major utilities are beginning to step up and procure or build solar without the requirements of a state Renewable Portfolio Standards (RPS) or other incentives. GTM refers to this market trend as ‘voluntary procurement’ (voluntary procurement is defined as the utility either purchasing the energy and environmental attributes from a third-party or owning the solar power plant).

A majority of solar energy development in southern states such as Florida, Georgia, Atlanta, and Mississippi is driven by voluntary procurement as seen in GTM Research’s report, The Next Wave of U.S. Utility Solar: Procurement Beyond the RPS. North Carolina and Virginia utilities are also voluntarily procuring. Further in North Carolina and Virginia customers are procuring solar through wholesale and retail procurement (wholesale and retail procurement represent the utility customer contracting directly with a third-party to purchase the energy from these systems). The GTM Research report predicts that 52 percent of solar installations in 2016 will be made from drivers other than state RPS.

Utilities in southern states have decided that renewable energy, specifically solar, is a promising energy path to follow, and regulators agree with them. In December 2015, Congress decided to extend the federal tax credits for solar through 2020 to accelerate growth. Large utilities such as Duke Energy and Southern Company are taking advantage of the tax credit extension by increasing their renewable energy portfolio to get ahead of carbon-reducing legislation. Southern Company has plans to invest $5 billion in renewables in the next three years. Duke Energy plans to invest $3 billion in the next five years in order to double their production and purchases of renewable power to 8,000 MW by 2020. Colin Smith, one of the main contributors to the GTM Research report says the solar industry as a whole is starting to see an increase in solar energy purchases from big-name utilities.

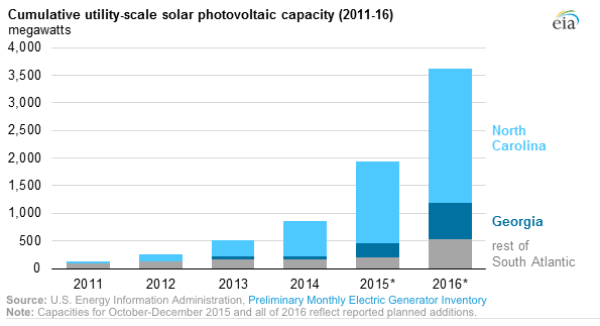

In their latest Integrated Resource Plan, Georgia Power requests an additional 525 MW of renewable energy, including solar by 2019. The state of Georgia plans to add more than 600 MW of utility-scale solar by the end of 2016, according to the Energy Information Administration. North Carolina is also a prominent leader in solar development given their ranking among the top ten states in 2015 for installed solar capacity. North Carolina invested over $1.6 billion in solar installations in 2015, which is a 159 percent increase from 2014. Investments are also increasing in Virginia, which received $28 million in 2015, an 86 percent increase from 2014.

Project developers such as our company, SolUnesco, are in an ideal position to support this growth in utility-scale solar. A casual review of the news demonstrates customers are increasingly demanding solar as part of their supply, and utilities are rapidly increasing supply to meet this demand. Moreover, the price of solar is decreasing. Prices of installed solar systems in the U.S. have dropped 6 percent from 2014 and 48 percent from 2010. Although North Carolina and Georgia are currently at the forefront of utility-scale solar growth, Virginia can be expected to harness its potential and expand its current market in the next few years. As solar in Virginia continues to grow, we look forward to supporting this market expansion.

Leave A Comment